With graduation this past weekend, there are lots of new grads heading out into the world in hopes of landing their dream jobs. The real world is full of exciting new opportunities and shocking realities such as student loans bills. Many young people will be looking for their first credit card and trying to learn how to balance all their finances. When I graduated, credit scores were a completely foreign world to me. Since I believe in not spending more than I have, I had never had a need for a credit card. But using a debit card and cash to pay for everything doesn’t do you much good, in fact it actually hurts you. In fact, the fewer credit cards you have, the more opportunity you are missing out on to raise your credit score. Those with more lines of credit can actually build their scores higher faster than those with fewer lines of credit. So although applying for multiple credit cards can seem like a bad idea, it’s actually quite the opposite.

This is because you aren’t taking the opportunity to build your credit score. I hadn’t realized how crucial this was until we applied for our first mortgage and were denied because of my low credit score. This wasn’t based on me having any negative history like not paying my bills on time. It was just because I literally did not have much history. I had already paid off all my student loans, and felt like that should count for something. Not to mention that we had gotten a car loan about 8 months earlier and had been making all our payments on that as well. Didn’t matter, we had to shop around quite a bit before we could find someone willing to give us our mortgage loan.

I’m happy to say 1 year later I’ve made it a point to build my credit score- and it’s up 120 points from last year. It started slow, at first all I could get was a “secured” credit card through our local bank (which was pretty much just a debit card, but it was reported to the credit bureaus as a credit card so that helped me raise my score). I added a couple of department store credit cards (JCPenney and Kohls) and that was it. But by doing those small things, my score increased enough that the really good cards are now available to me!

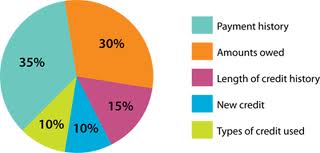

So how does a credit score work? Here’s the basic breakdown:

Payment History (35%): The biggest aspect of it comes from your ability to pay your bills on time. I always advise to pay your full amount owed each month in order to avoid insanely high interest charges. I would say if you aren’t going to be able to pay your full bill, don’t get credit cards at all.

Amounts Owed (30%): Next up is the current outstanding balance you owe on credit lines. When I’m getting ready to apply for a new card, I always make sure I first go and pay off all my current balances, even if they aren’t due yet. Usually it takes 1-2 business days for this process, so keep that in mind if you try to do this on a Friday, it may take until Monday or Tuesday for the payments to go through.

If you aren’t able to pay all your balances off when you want to apply for a new card, pay attention to which credit cards have the most spending on them in ratio to the total credit line. For example, if you have a $500 balance on a credit card that has a $1,000 limit, that means you’re using 50% of the available credit. However, if it’s a $500 balance on a card with a $10,000 limit, that’s much different (only 5%). If you’re applying for bank credit cards (Chase cards are my favorite!) you can also make sure to pay down the balances you have on current cards with that bank.

Length of Credit History (15%): The longer you have a credit card, the better. Unless I run into a point someday where I can no longer new credit cards because my amount of available credit lines is already so high, I don’t get rid of credit cards that have no annual fee. There’s just no point. You might as well keep them. However, if you want these to show up on your credit score and help prove that are responsible in the long term, you need to be using them regularly. I have a couple cards that I’ve had for a while and really don’t have great rewards at all. So in order to still take advantage of them boosting my score since I’ve had them a while, I just charge one thing per month on them. One of them is set to pay our Netflix account ($7.99 total) and the other I use for redbox movie rentals ($1.20 each time). It’s next to nothing in spending, but it still is reported to the credit bureaus that I’m using it.

New Credit (10%): This can negatively affect your score if you have tons of new credit cards without much history behind them. Or if it looks like you’re going on a crazy credit card spree. But I’ve gotten quite a few over the last few months and never had a problem. I’ve spaced them out by a few weeks and months- I didn’t apply for 6 all at once in the same month. I’m going to lay off new credit cards for probably a the rest of the year now to take a break and let these build. Unless an offer comes up that I just can’t refuse 🙂 The application for your new credit card shows on your credit report for 2 years (seems like forever!) which can also hinder you in getting approved for new cards. But I’ve heard that most credit card companies don’t care about them after 6 months.

*I’ve also heard that if you are thinking about applying for a mortgage, you may want to hold off on applying for any new credit cards for the two years prior to the mortgage application. But honestly, I don’t know the reasoning behind this or if it’s really that true. More research needs to be done.

Types of Credit Used (10%): This just refers to the many aspects of credit: student loans, car loans, mortgage loans, credit cards, etc.

Hope that gives at least a little more understanding for you. Get out there and start building credit!! If you’re looking for one card to start with, I’d recommend the Chase Freedom card and you can read about that here. It doesn’t have an annual fee and I think it’s always safer to start with that route. Chase is just my favorite bank for rewards, especially because you can combine all your points from all your Chase cards together! Best thing about Chase Freedom to me are the rotating categories of earning bonus 5% back- especially on gas and restaurants!

Last tip- it’s free to check your credit score once each year. I definitely recommend doing this before you apply for your first card so you can get an idea of your ballpark range. You can also take advantage of the Barclay World Arrival MasterCard, among others, which gives you your updated credit score on a monthly basis for free.