Interested in getting into travel hacking? Or maybe just looking for a good credit card with cashback benefits and a sign up bonus? Or maybe you’re just starting to learn about credit cards and looking for advice on a first credit card to start with. If any of this applies to you, I always recommend the same card: Chase Freedom. And right now they’re offering a huge bonus to sign up!

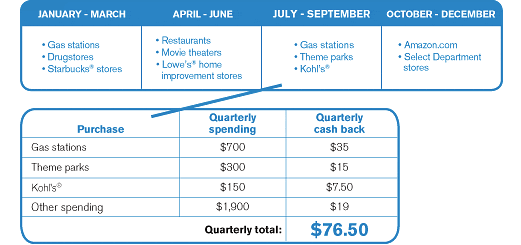

This card has some fantastic benefits. It includes 1% cashback on all purchases, but the real perk is the 5% cashback categories they offer. These change each quarter, but always have good offerings. Take a look at what these included in 2014 and an example of what your cashback could look like from the 5% categories.

Each quarter you can only earn the extra 4% cashback on the first $1,500 you spend (a max of 7,500 points=$75). However you will always earn the regular 1% on all purchases above the $1,500 in the categories or any other purchases that don’t fall into the categories. Last year when gas stations were included in the quarterly bonus, I always made sure to use my Chase Freedom card at the pump. When we were approaching the end of the quarter (end of March for example) I bought gift cards to the gas station that would cover for the next quarter. I earned 5% on the giftcards and used those over the next 3 months when I could no longer earn the 5% with Chase Freedom. Once July hit, I repeated the whole strategy all over again.

Another big attraction to starting out with this card is that there is NO ANNUAL FEE! That means you can keep this baby in your wallet forever. It will build up your credit score since you’ll hold it for a long time. Additionally right now is the perfect time to apply as they’re offering 20,000 bonus points (which can be redeemed for $200 cashback) after spending $500 in the first 3 months. The spending requirement of only $500 is extremely low and shouldn’t be tough to meet if you put all your spending on the card. Click here to fill out your application! First quarter of 2015 categories were recently announced and are going to feature 5% cashback on groceries!

Finally, this is a good card to use for future investments as well. When you’re feeling more comfortable with the credit cards, you can apply for the Chase Sapphire Preferred card next. Read more about it here. The Chase Sapphire card allows you to transfer your points directly to airlines for free flights, which the Chase Freedom does not allow. However, if you hold both cards, you can combine your points and use them all for travel.

Bottom line, if you’re thinking about expanding your credit cards, this is the one and now is time!

One thought on “A Beginner’s Credit Card”